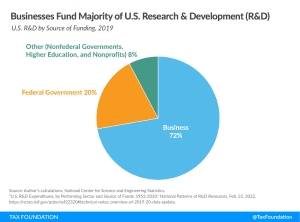

The research below explores the economics of tax policy and the intellectual underpinnings of our efforts to quantify tax changes using our dynamic Taxes and Growth (TAG) macroeconomic model.

In an attempt to provide a realistic, data-driven analysis of federal tax policy, the Tax Foundation has developed a General Equilibrium Model to simulate the effects of tax policies on the economy and on government revenues and budgets.

Lawmakers should use the most comprehensive analytical tools available to them—like dynamic scoring—to make informed decisions about policy changes.

Recent empirical evidence shows that workers bear upwards of 70 percent of the corporate income tax burden, much more than popular tax models claim, which make errors in how they account for super-normal returns and the openness of our economy.

Some tax hikes are more damaging than others, according to Congressional Budget Office (CBO) and new Tax Foundation economic modeling.

A new trade war could wipe out the benefits of pro-growth tax reform.

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

Lawmakers should prioritize creating a tax system that supports investment more broadly rather than subsidizing specific industries and allowing broad, neutral pro-investment provisions to expire.

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

Gross income definition or gross pay definition TaxEDU Labor Share of Net Income is Within Its Historical Range President Biden Made in America Tax Plan and American Jobs Plan" width="300" height="225" />

Gross income definition or gross pay definition TaxEDU Labor Share of Net Income is Within Its Historical Range President Biden Made in America Tax Plan and American Jobs Plan" width="300" height="225" />

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

Design Matters When Raising Taxes to Reduce the Deficit and Stabilize the Debt-to-GDP ratio US debt taxes deficits Gross Domestic Product GDP" width="300" height="200" />

Design Matters When Raising Taxes to Reduce the Deficit and Stabilize the Debt-to-GDP ratio US debt taxes deficits Gross Domestic Product GDP" width="300" height="200" />

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

While research on optimal taxation often focuses on the pure economic implications, it rarely considers cultural and societal differences that can lead to very different outcomes when trying to implement an optimal tax system.

In our latest report, we consider several theoretical arguments for carbon taxes and the evidence from carbon taxes implemented around the world related to emissions, economic growth, distribution and revenue recycling options, other environmental taxes, green subsidies, and environmental regulations.

Our recent policy conference brought together academics and political leaders to present research on some of the most pressing issues in global tax policy and to discuss solutions that can unlock genuine global growth.

Lawmakers should use the most comprehensive analytical tools available to them—like dynamic scoring—to make informed decisions about policy changes.

History is clear. Lowering budget deficits via spending restraint frees resources for additional private output and jobs. Lowering them by raising taxes on business investment and labor services makes it harder to dis-inflate without a recession.

As we near this year’s “lame duck” session of Congress, there has been renewed interest in reforming the child tax credit as part of a tax deal. Our new analysis highlights the trade-offs that policymakers will face

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

Research has shown that spikes in tax rates can act as barriers to upward mobility. High marginal tax rates might directly influence the decisions workers make about accepting a raise, working additional hours, or whether they might remain on government benefits.

Research almost invariably shows a negative relationship between income tax rates and gross domestic product (GDP). Cuts to marginal tax rates are highly correlated with decreases in the unemployment rate.

The Biden administration has pledged to not raise taxes on anyone earning less than $400,000 a year. However, the administration’s corporate tax proposals would likely violate that pledge, given that corporations are comprised of people who also might earn less than $400,000.

Page 1 of 5 1 2345Stay informed on the tax policies impacting you.

About

Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy in the U.S. and internationally. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Donate

As a nonprofit, we depend on the generosity of individuals like you.